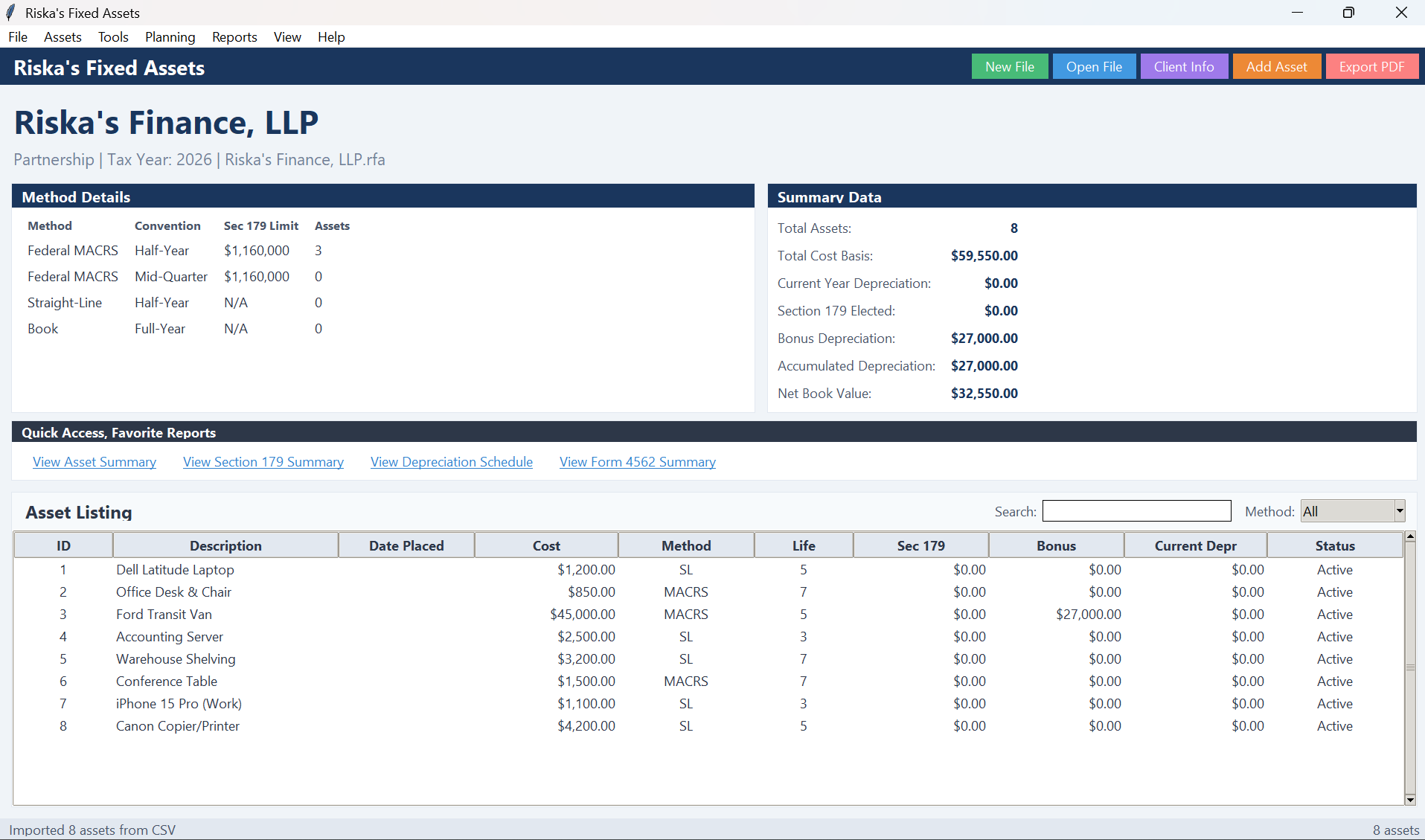

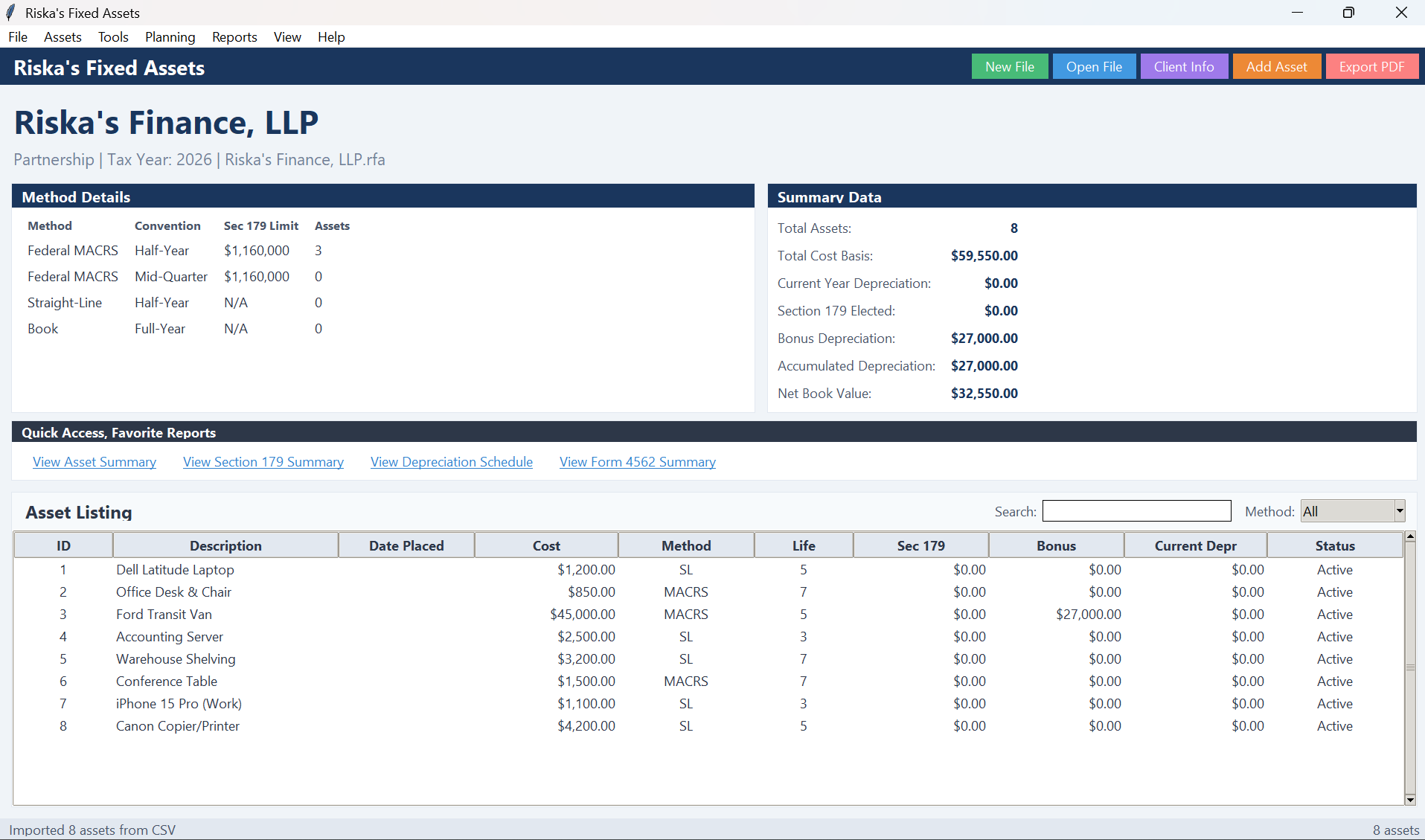

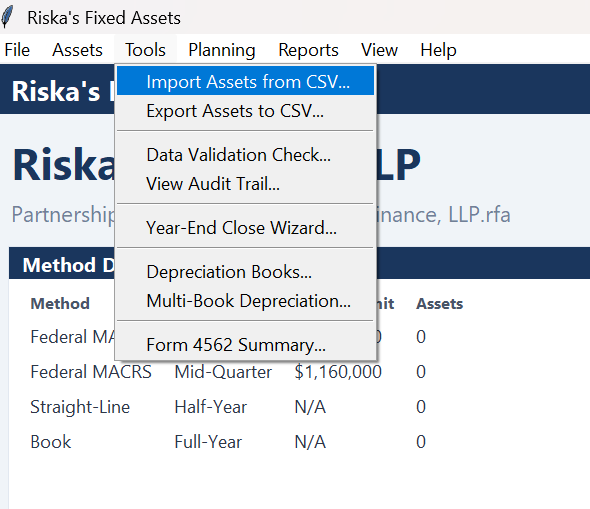

Comprehensive Fixed Asset

Management Software

Developed by accountants, for accountants. Simplify asset tracking, automate MACRS depreciation, and generate tax-ready reports with confidence.

Developed by accountants, for accountants. Simplify asset tracking, automate MACRS depreciation, and generate tax-ready reports with confidence.

Scalable architecture designed to meet the rigorous demands of financial professionals.

Manage unlimited client entities.

Simplify internal bookkeeping.

Forecasting and budget planning.

Track equipment and write-offs.

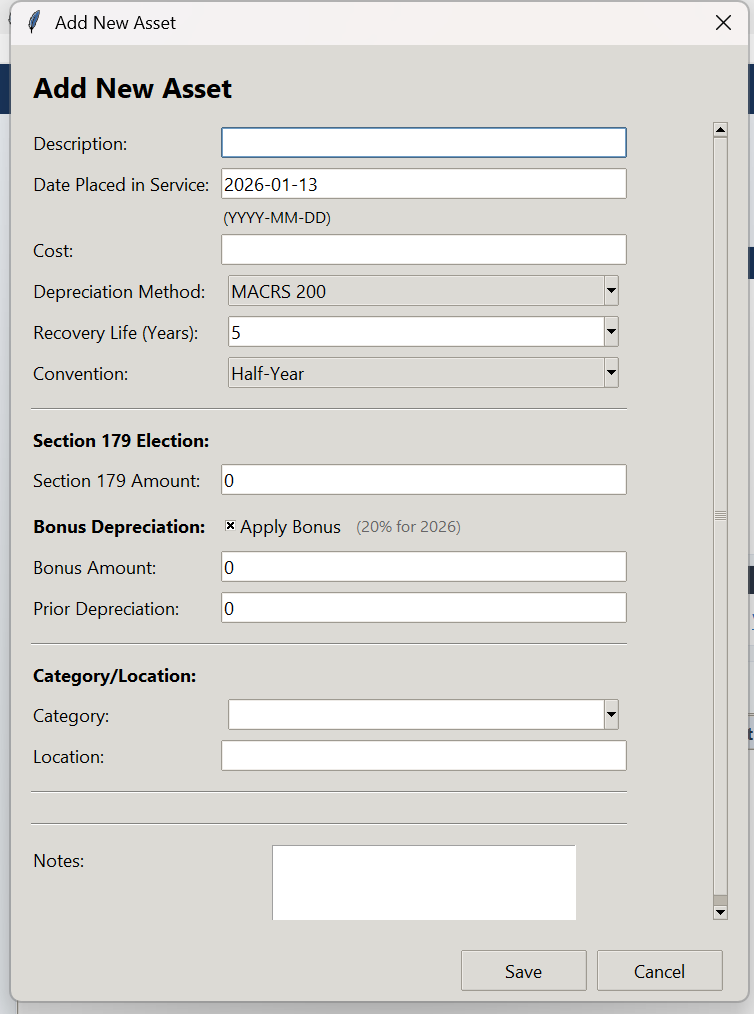

Eliminate manual calculation errors. Our intelligent entry wizard ensures compliance with the latest tax codes.

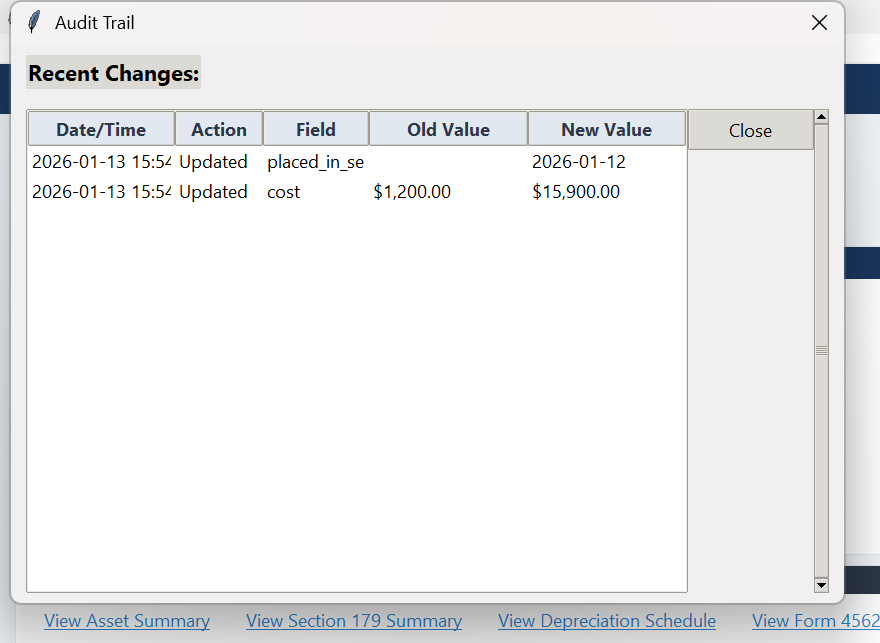

Maintain granular control over your financial data. Riska's Fixed Assets is built for audit readiness.

Generate professional, exportable reports for tax filing, management review, and budget forecasting.

One time purchase. Own your software.

Secured via Stripe

Double-click the installer (setup.exe).

Locate the app in Finder after downloading.

Windows 10/11 (64-bit) or macOS 12+ • 1GHz Processor • 4GB RAM • 500MB Disk Space